Governance-First Capital Management for Philanthropic Institutions

Willohsen helps foundations and donors pool, deploy, and steward capital under shared governance—supporting long-term impact within fiduciary boundaries.

EVERGREEN. DISCIPLINED. BUILT FOR COLLABORATION.

The Institutional Reality

Many foundations and donors share a common set of constraints—not due to lack of intent, but due to structure.

Endowment and DAF assets are difficult to activate beyond grants

Collaborative deployment across funders is administratively complex

Promising opportunities often require governance capacity, not just capital

Existing vehicles prioritize preservation over circulation

The result is well-intended capital that is too cautious to move collectively. These constraints are common— and solvable with the right structure.

Our Approach

Willohsen Capital is a governance-first capital manager designed to help foundations and donors move capital together—responsibly, intentionally, and repeatedly.

We provide the shared infrastructure required to pool capital, conduct disciplined diligence, and steward capital across philanthropic, concessional, and market-rate strategies.

By centering governance, fiduciary clarity, and collaboration, institutions can act collectively without sacrificing control, accountability, or mission alignment.

Institutions engage with Willohsen at their own pace, within structures appropriate to their mandates.

How Capital is Governed

Four Governance Principals

Capital Circulation

Willohsen prioritizes the deployment, recycling, and redeployment of capital to avoid stagnation and increase long-term utility. Where appropriate, structures are designed to return capital so it can be reused in service of mission over time.

Grounded Decision-Making

Investment discovery and diligence are informed by practitioner expertise, local context, and human judgment—not abstract models alone. This ensures decisions reflect real operating conditions and institutional constraints.

Responsible Stewardship

Capital is stewarded with an emphasis on durability, accountability, and appropriate return expectations. Structures are tailored to balance mission alignment with financial responsibility across different forms of capital.

Fiduciary Discipline

All activity operates within clear fiduciary frameworks appropriate to each partner, vehicle, and mandate. Governance is designed to reduce risk, preserve trust, and support long-term collaboration.

Ways To Work with Willohsen

Institutions may engage with Willohsen in different ways, depending on mandate, risk tolerance, and desired level of involvement.

-

Willohsen serves as a donor-advised fund sponsor for foundations and donors seeking a governed home for philanthropic and concessional capital.

Our DAF structures are designed to support pooled deployment, disciplined recycling, and long-term stewardship—enabling partners to move beyond one-time grantmaking while remaining within established fiduciary norms.

This option is appropriate for institutions seeking:

Direct assets under management

Shared governance with aligned partners

Long-term capital circulation strategies

-

Willohsen works with community foundations and other sponsors as an external investment and governance manager.

Capital remains with the sponsoring institution, while Willohsen provides governance design, diligence, investment management, and ongoing stewardship. This allows institutions to pilot new capital approaches without restructuring existing vehicles or migrating assets.

This option is appropriate for institutions seeking:

Low-friction experimentation

Retention of legal and administrative control

Governance and investment support without asset transfer

-

Willohsen manages a venture-oriented fund of funds for aligned limited partners and mission-related investments.

This vehicle applies conventional venture economics while extending Willohsen’s governance discipline into innovation and emerging fund managers—supporting long-term platform sustainability and mission alignment.

This option is appropriate for institutions seeking:

Market-rate exposure

Mission-aligned venture participation

Portfolio diversification within a governed framework

An Integrated Capital System

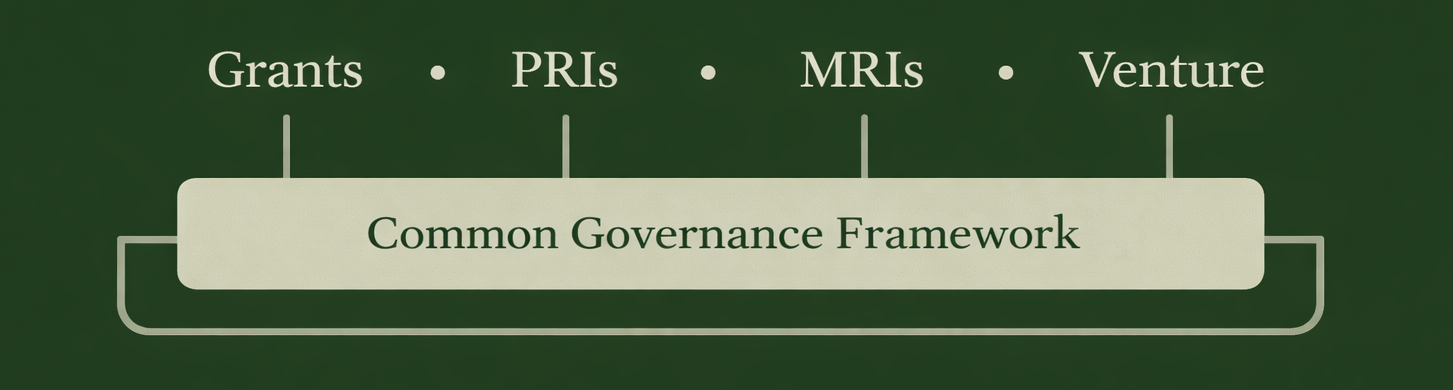

Willohsen supports grants, program-related investments, mission-related investments, and venture capital within a single governance framework.

Different forms of capital are deployed for different purposes—but governed through the same principles of discipline, accountability, and collaboration.

This integrated approach allows institutions to engage across the capital spectrum without fragmenting oversight or increasing risk.

Who We Work With

Willohsen works with institutions and partners seeking disciplined, collaborative approaches to capital stewardship.

Private and family foundations

Community foundations

Donor collaboratives

Philanthropic families and their advisors

We also engage with:

Aligned limited partners

Mission-related and program-related investment committees

Public and quasi-public capital partners

Meet the Founders.

Willohsen Capital is led by experienced capital stewards with a track record of governing, deploying, and recycling capital across philanthropic, concessional, and market-rate structures.

Together, the founding partners bring complementary expertise in investment management, governance design, and institutional strategy—grounded in real capital deployment and long-term accountability.

-

Founding Partner & Chief Investment Officer

Dr. Shanté Williams is a capital activist and impact fund manager with deep experience stewarding capital across global markets. As CEO of Black Pearl Global Investments, she has led more than $25 million in venture investments advancing health equity, innovation, and inclusive economic outcomes, with a focus on Africa, the Caribbean, and underserved communities worldwide.

Her background spans venture investing, mergers and acquisitions, technology commercialization, and intellectual property strategy. Dr. Williams has guided ventures from early stage through growth and exit, bringing rigorous investment discipline alongside a practitioner’s understanding of operating risk and opportunity.

At Willohsen, Dr. Williams is responsible for investment oversight, diligence, and portfolio stewardship—ensuring capital is deployed responsibly, governed rigorously, and aligned with long-term mission and fiduciary objectives.

-

Founding Partner & Chief Strategic Officer

Kasem Rodriguez Mohsen is a social entrepreneur and impact investment strategist focused on designing governance-first capital systems. He has spent two decades working at the intersection of philanthropy, venture capital, and public funding, helping institutions deploy capital in ways that are disciplined, collaborative, and non-extractive.

As founder and CEO of LION Strategies, Kasem has partnered with foundations and mission-driven institutions—including the Lemelson Foundation and Aspen Institute—to design and deploy more than $500 million in values-aligned capital across multiple vehicles and geographies. He is also a serial founder with three successful exits, bringing a full lifecycle understanding of enterprise growth and capital dynamics.

At Willohsen, Kasem leads strategy, governance design, and institutional partnerships—ensuring structures are durable, legally sound, and capable of supporting long-term collaboration and capital circulation.

Shared Stewardship

Together, the founding partners steward Willohsen Capital with a shared commitment to fiduciary discipline, governance integrity, and the responsible movement of capital in service of long-term impact.

Explore a Partnership

Willohsen works with foundations and donors who are exploring pooled capital, governance-first investment strategies, and disciplined approaches to capital stewardship.

If your institution is considering new ways to deploy capital—whether through donor-advised funds, external fund management, or integrated investment structures—we welcome a conversation.

Our role is to provide clarity, governance, and fiduciary alignment—so institutions can move capital together, responsibly and at their own pace.